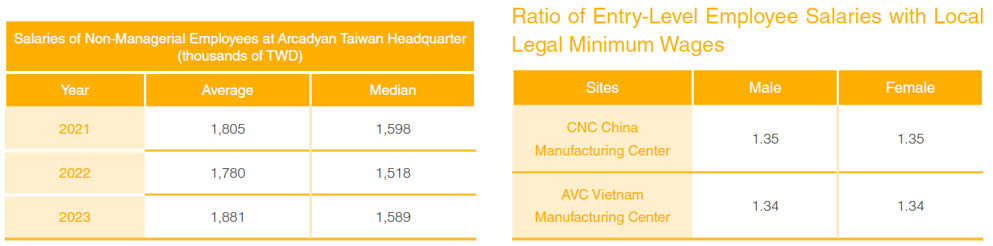

Salaries and Rewards

Arcadyan has established a fair salary and remuneration system to ensure that employee compensation aligns with relevant regulations and maintains market standards. All formally employed staff are entitled to statutory insurance and retirement plans. Arcadyan practices an equal pay policy, ensuring no discrimination based on race, nationality, age, social status, ancestry, religion, physical disability, gender, sexual orientation, family responsibilities, marital status, or political views.

The remuneration system considers overall compensation, including a fixed monthly salary, annual (holiday) bonuses, patent bonuses, project bonuses, and various other incentives. Annual salary adjustments are based on company profitability and individual performance. All employees undergo performance evaluations twice a year, with the results informing rewards, appointments, promotions, and other personnel management decisions.

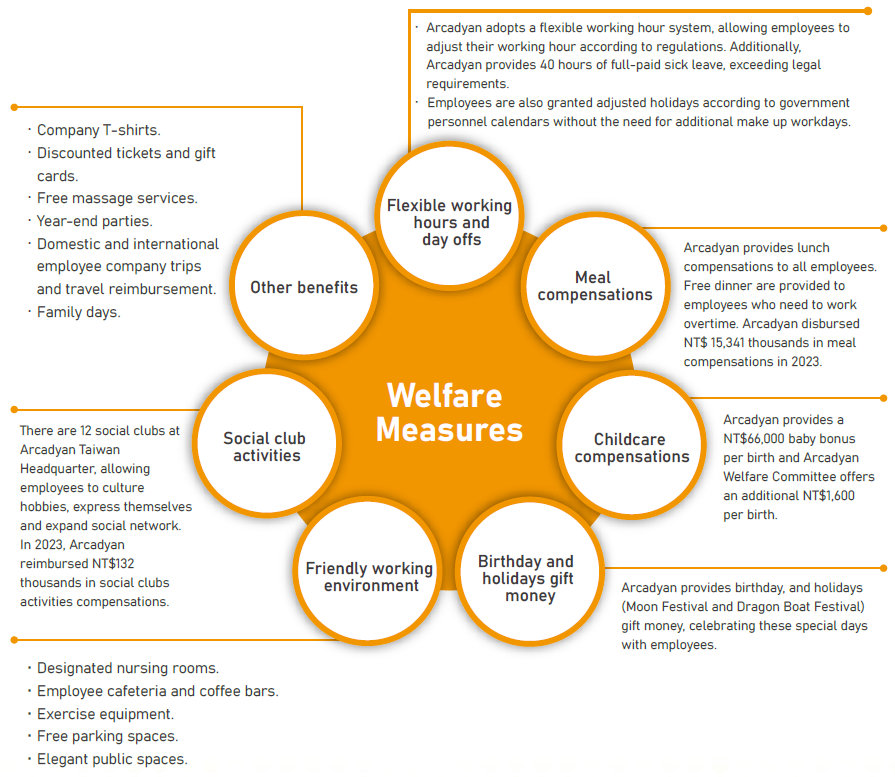

Arcadyan has established an Employee Welfare Committee in accordance with government regulations. In addition to providing various subsidies for employees' weddings, funerals, illnesses, and childbirth, the company regularly organizes various club activities, trips, birthday celebrations, and evening events to promote employees' physical and mental well-being and enhance interaction among staff. Arcadyan also offers comprehensive personal protection for employees by providing not only the insurance required by labor laws but also superior group insurance for employees and their families. This includes life insurance, accident insurance, cancer insurance, and medical insurance.

Employees at overseas manufacturing centers also enjoy legally mandated insurance, including social insurance, medical insurance, unemployment insurance, and other legally required benefits, in accordance with local laws. Arcadyan has established an "Employee Welfare Committee," which allocates welfare funds as required by law, holds regular committee meetings, and organizes employee welfare activities to support the diverse development of club activities.

Baby Bonus and Parental Leave

Supporting government policies aimed at boosting Taiwan's population growth rate, Arcadyan has been offering a baby bonus of NT$66,000 per birth since 2011. As of 2023, a total of 337 newborn babies have been born among Arcadyan employees, with approximately NT$22.24 million disbursed in incentives. Arcadyan has also partnered with childcare facilities and early childhood education institutions to offer employees discounted childcare or preschool education services, easing parents' financial burden on childcare.

Regardless of gender, Arcadyan employees can apply for parental leave in accordance with the Gender Equality in Employment Act and the Regulations for Implementing Unpaid Parental Leave for Raising Children. Employees at the Taiwan headquarter who have been with the company for at least six months can apply for parental leave until their children reach three years of age. The maximum duration of parental leave is two years, after which employees are reintegrated into their original or related departments and provided with necessary trainings to facilitate the transition. Additionally, Arcadyan offers compassionate workplace policies such as maternity leave, prenatal check-up leave, childbirth leave, paternity leave, antenatal care leave, family care leave, lactation rooms, and maternal health protection. Arcadyan has also established contracts with qualified and reputable childcare centers to support employees' childcare needs from all aspects. Overseas manufacturing centers also comply with local regulations regarding maternity and parental leave.

Retirement Plan

Arcadyan has a Retirement Supervisory Committee and has established Employee Retirement Regulations. Each year, an external actuary ensures adequate contributions to safeguard the rights and interests of employees. Since the implementation of the Labor Pension Act on July 1, 2005, employees were allowed to choose between the old and new retirement systems. Under the old system, the contribution rate is 2% of monthly salary, and as of the end of 2023, the balance in the retirement account is NT$141,037,000. For employees under the new system, 6% of their monthly salary is contributed to their individual retirement accounts at the Labor Insurance Bureau. In overseas manufacturing centers, a certain percentage of employee salaries is contributed to government social insurance accounts according to local social insurance systems (16% in China, 14% in Vietnam).

At the end of 2023, Arcadyan recognized retirement expenses for subsidiaries included in the consolidated financial statements totaling NT$112,346,000. Other expenses for labor insurance and other employee welfare expenses for subsidiaries included in the consolidated financial statements amounted to NT$902,296,000 at the end of 2023.

Arcadyan 2023 Event Highlights

-

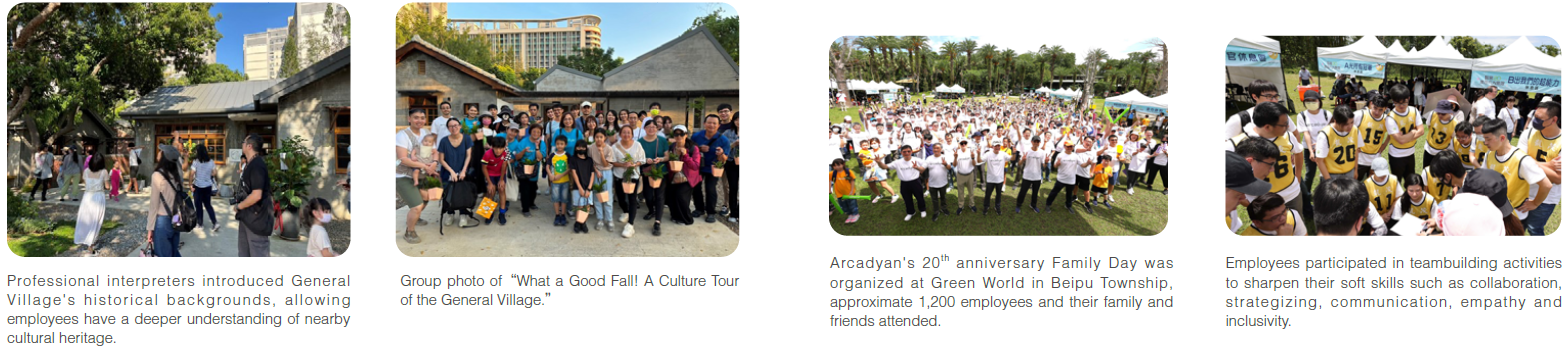

What a Good Fall! A Culture Tour of the General Village

Arcadyan Taiwan Headquarter neighbors a Hsinchu Municipal Cultural Heritage “General Village.” In 2023, Arcadyan collaborated with Hoh Market Cooperative to host “What a Good Fall! A Culture Tour of the General Village,” introducing General Village's history through professional interpreters to employees. The tour incorporated a DIY session and a local market, employees enjoyed a cultural afternoon with their family and friends. “What a Good Fall! A Culture Tour of the General Village” offers two time slots, a total of 80 employees and their family and friends attended.

-

Arcadyan 20th Anniversary Celebration

2023 is Arcadyan's 20th anniversary. Family Day was organized at Green World in Beipu Township, approximate 1,200 employees and their family and friends attended. Four teams were form across different departments go participate in the teambuilding activities. Employees sharpen their skills in collaboration, strategizing and communication. With empathy and inclusivity, all teams completed the team tasks. Aligning with the company's sustainable principles, employees are encouraged to bring water bottles to refill, and catering services are chose from local vendors. Arcadyan celebrated its birthday with all employees while being environmental conscious.